Quick Start Guide

Setting up Risk Management as a service

1

Login

Log into your CyberTools.Club account.

2

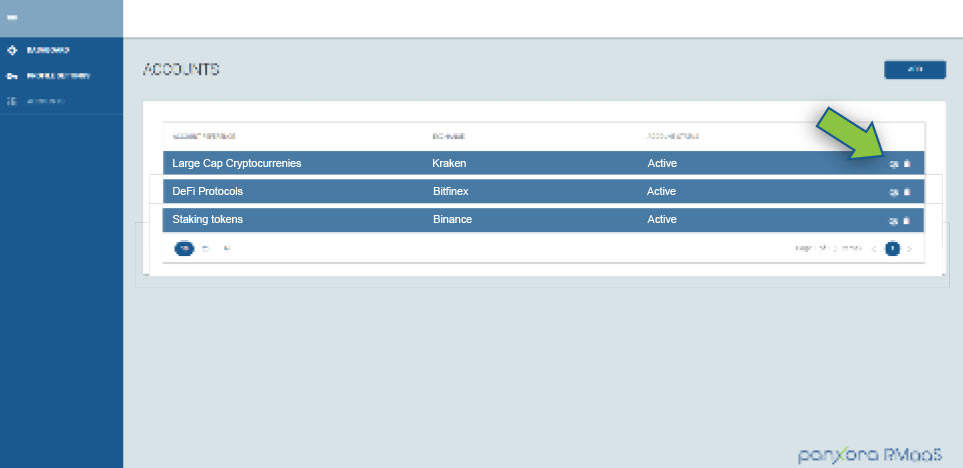

Select the exchange account to edit

- Add a new exchange account to your CyberTools dashboard or

- To work with an existing exchange account, from the left hand menu select ACCOUNTS, then select the exchange you want to work with by tapping the

icon for that exchange account.

icon for that exchange account.

3

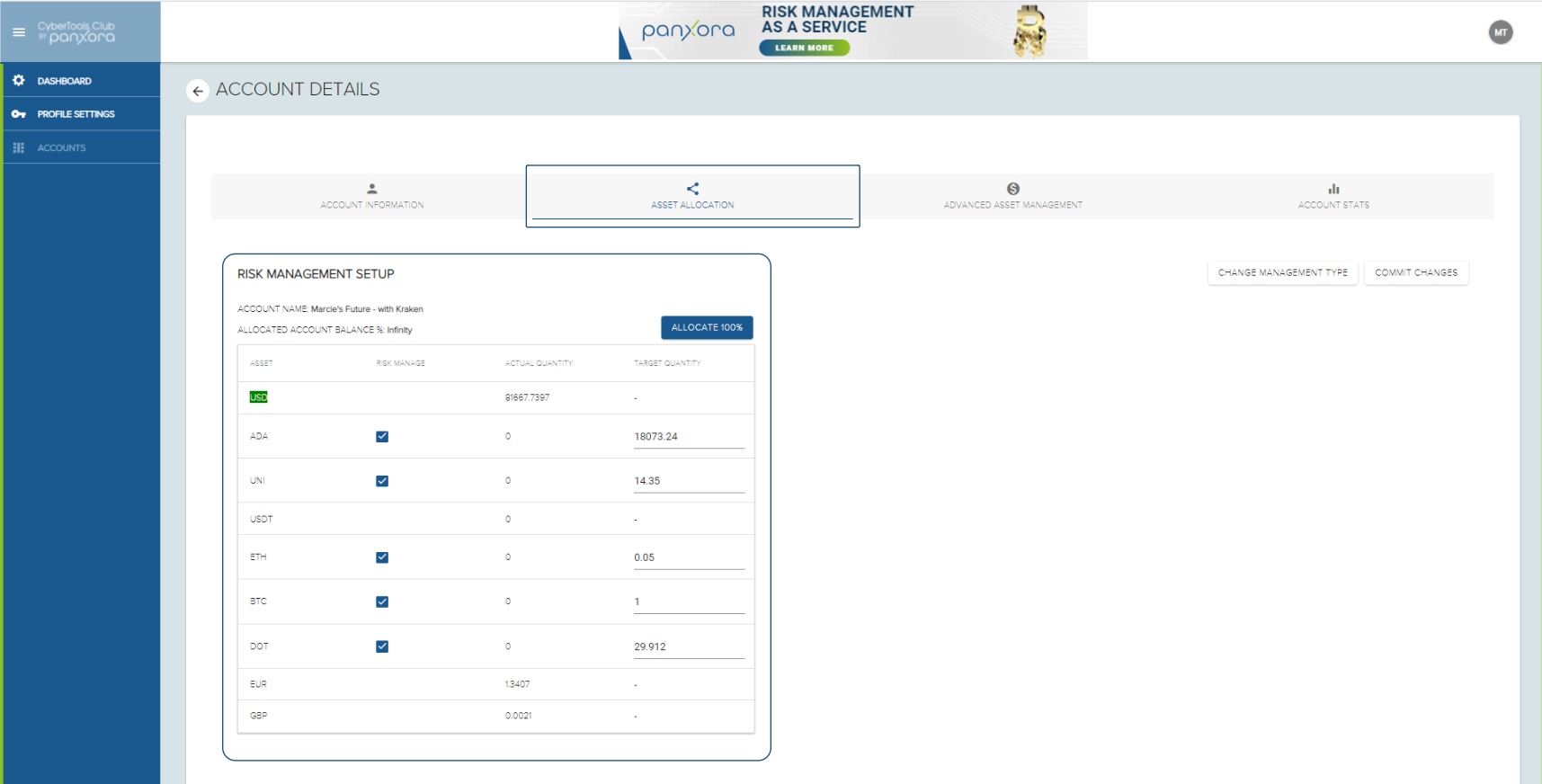

Select the Asset Allocation tab

Tapping the ASSET ALLOCATION button will pull in the existing assets list from the cryptocurrency exchange account. Check the boxes for the crypto-assets to be risk managed. In the ‘Target Quantity’ column enter the number of coins that should be in the account when the risk models want to be fully committed to that asset. For example, if the account currently holds 100 ADA, that amount will be displayed in the ‘ACTUAL QUANTITY’ column. If the amount is changed in the ‘TARGET QUANTITY’ column once ‘COMMIT CHANGES’ is selected the system will change the number of coins held to the new quantity – This will only take place if the system is fully committed to cryptocurrency. If the system thinks that volatility is high and it should be in cash, once the changes have been confirmed, the model will move the appropriate amount into cash. What happens is dependent on the allocation selected and the model’s current risk assessment of the market.

Tapping the ALLOCATE 100% button will look at any available cash in the exchange account and the current market price for all the cryptocurrencies in the account. If the market is stable so that the system wants to be fully committed to a crypto position, it will proportionally assign the available cash to those markets and purchase them once the ‘COMMIT CHANGES’ button is tapped. If the model thinks the market is too risky to hold crypto or only wants a partial position, it will purchase some or none of those assets until it decides volatility has lessened.

4

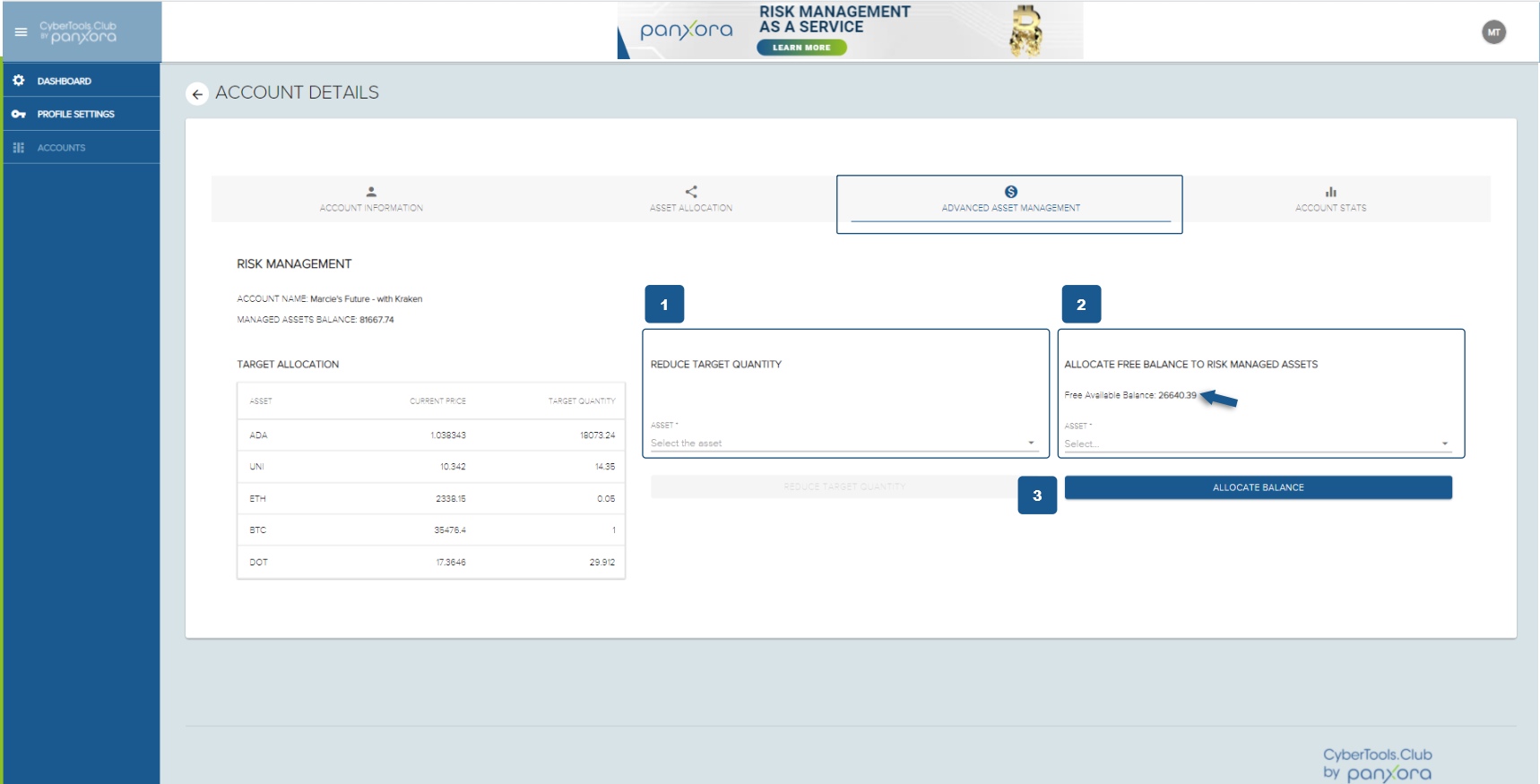

Advanced Asset Management

The Advanced Asset Management tab is used to refine your position or to add new assets to the complement of cryptocurrencies that you hold and risk manage.

-

- REDUCE TARGET QUANTITY – To reduce the target quantity for a specific cryptocurrency select the asset from the drop-down menu, then enter the new number of tokens you would like to have in the account when the risk model wants to be fully invested in cryptocurrency. Remember, that if the risk model determines that a 100% position is too risky it may not adjust the value held in the account when you commit the changes to this page.

- ALLOCATE FREE BALANCE TO RISK MANAGED ASSETS – Current market prices coupled with the model’s current investment level preference results in FREE AVAILABLE BALANCE. This balance can be applied to invest in other assets. However, it is important to note that if the model is not fully invested due to increased market volatility using the FREE AVAILABLE BALANCE may impact the model’s ability to achieve the designated TARGET QUANTITIES, once market volatility falls and the model wants to purchase cryptocurrency again. It is therefore a good idea to leave some spare cash in FREE AVAILABLE BALANCE so if prices rise before full reinvestment takes place, the models will have sufficient capital to purchase the TARGET QUANTITY for all risk managed assets.

- Once all adjustments have been made to the account tap the ALLOCATE BALANCE button to commit to the designated changes.

5

Exchange Account Dashboard

The current positions for this exchange will display along with performance statistics. Five days of data will be required before an accurate Sharpe and Sortino ratio can be displayed.